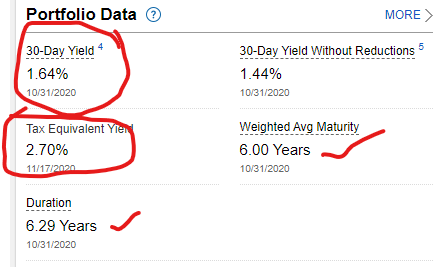

fidelity california tax free bond fund

For taxable accounts Fidelity Equity-Income Strategy may apply tax-sensitive investment management techniques on a limited basis at Strategic Advisers discretion primarily with respect to determining when assets in a clients account should be bought or sold. The fund has returned -1101 percent over the past year 1592 percent over the past three years 1621 percent over the past five years and 1609 percent over the past decade.

Municipal Bonds Types Uses Benefits Napkin Finance

As a discretionary investment management service any assets contributed to an investors account that Fidelity.

. 1 However if these bonds were used to pay for such private activities as housing projects hospitals or certain industrial parks the. Fidelity California Short-Intermediate Tax-Free Bond Fund Fidelity Tax-Free Bond Fund Interest income generated by most state and local municipal bonds is generally exempt from federal income tax andor AMT.

Are Tax Free Muni Bonds Right For Your Portfolio What To Know

How To Buy Municipal Bonds Ally

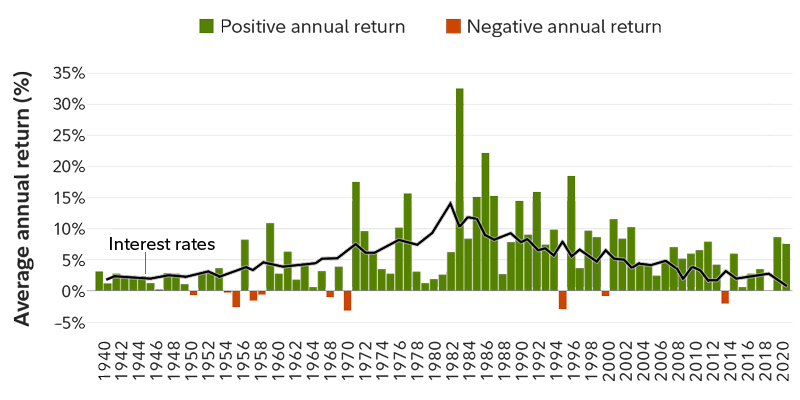

Market Watch 2021 The Bond Market Fidelity

Investing Bond Market Outlook Fidelity

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Cfbax Climate Focused Bond Fund Class A Lord Abbett

A Smart Strategy For Municipal Bond Investors Barron S

Term Cef Ladder 7 National Municipal Bond Funds Nyse Bkk Seeking Alpha

:max_bytes(150000):strip_icc()/GettyImages-1075439388-0c5834aa38c9485ab552acdbe393975e.jpg)

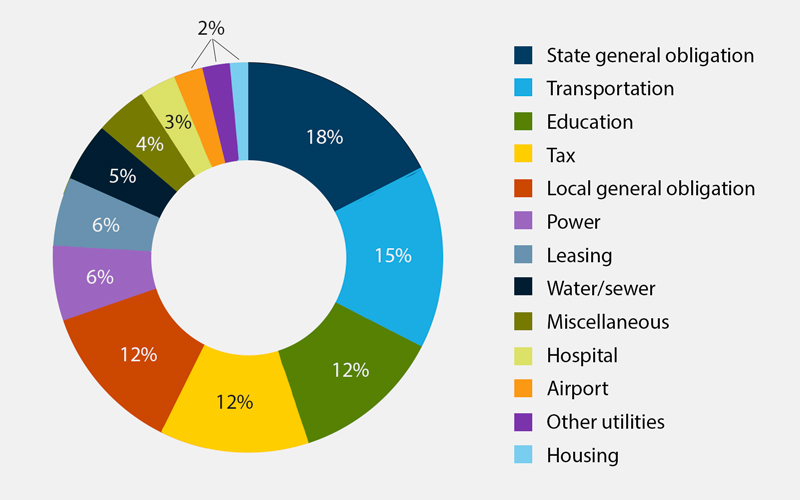

Should You Consider Muni Bonds

How To Invest In Bonds White Coat Investor

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

What Are Municipal Bonds And How Do These Tax Free Securities Work

Market Watch 2021 The Bond Market Fidelity

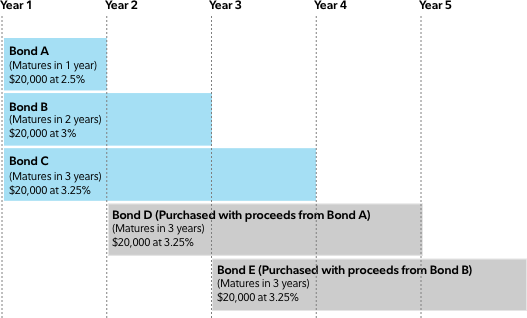

Bond Ladder Tool From Fidelity

/GettyImages-182715445-64884f93e3b641ad96f080d2c1e0838e.jpg)

Top 5 Corporate Bond Mutual Funds

How To Invest In Bonds White Coat Investor

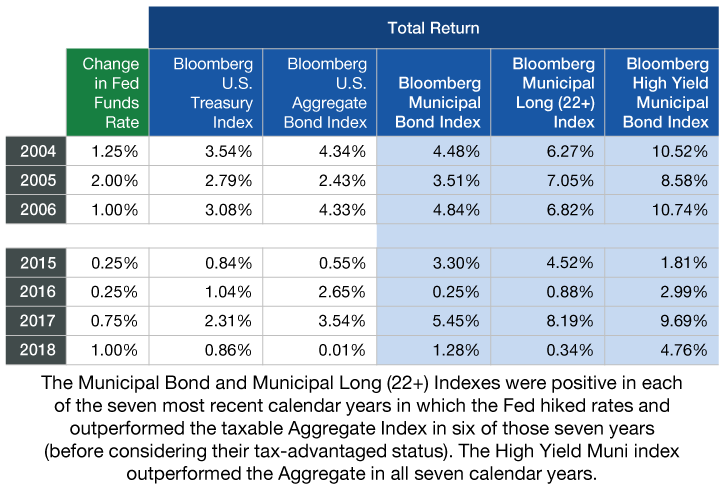

Municipal Bonds And Rising Rates 3 Considerations For Investors

/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg)